Married retirement calculator

If you are married you need to use a retirement calculator for married couples or a retirement calculator for couples. Were providing this tool to assist with your federal income tax withholding.

Best Retirement Calculator For A Couple Wealthtrace

Robust modeling of couples Social Security pensions real estate health care taxes inflation.

. He is a 30 years old married man who is planning to. Our retirement calculator takes into account the average Canadian retirement income from the Old Age Security OAS and Canada Pension Plan CPP for 2018. Getting married Buying a home Starting a family Saving for school.

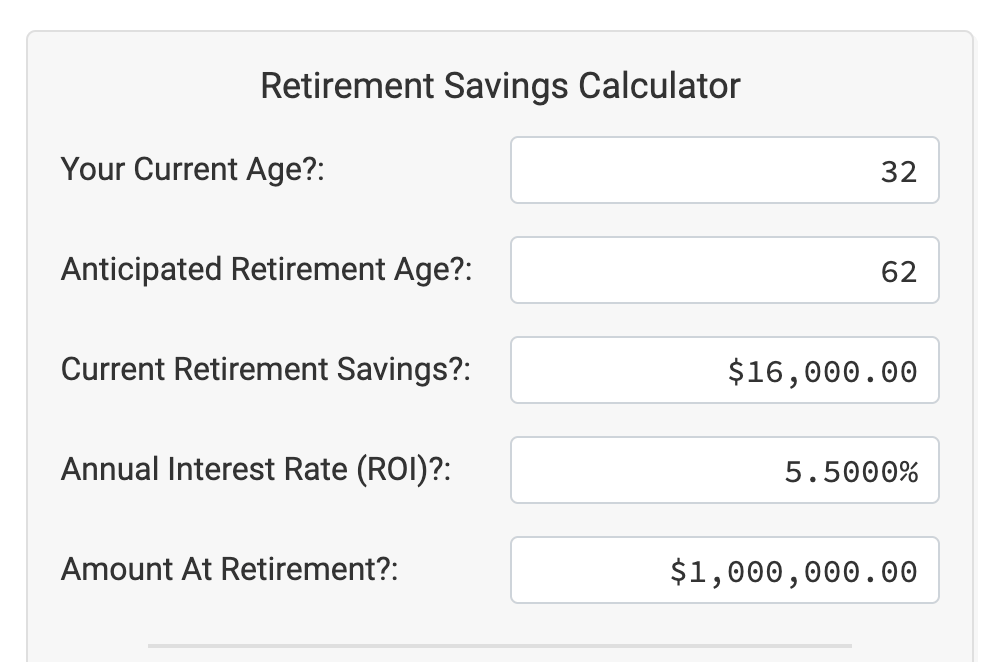

Thus spouses employment status may affect ones decision to retire. Retirement planning when you are married or part of any kind of committed couple is doubly complicated. Retirement Calculator is an online tool which will help you to calculate your retirement corpus.

This calculator will show you the average number of additional years a person can expect to live based only on the sex and date of birth you enter. Make sure you use a retirement calculator that allows you to customize different phases with different levels of spending. To see how much you might need complete the calculator below.

Switch to California hourly calculator. You can put in up to 6000 a year. And if youre 50 or older you can.

It is better to start planning the retirement funds needed for a stress-free lifestyle post-retirement and start investing in it. This calculator assumes that the year you retire you do not make any contributions to your retirement savings. Above these secondary limits only 15 is deductible.

For taxpayers above those limits but below 34000 for single filers or 44000 for joint filers half of Social Security retirement income is deductible. The calculator below can help estimate the financial impact of filing a joint tax return as a married couple as opposed to filing separately as singles based on 2022 federal income tax brackets and data specific to the United States. Georgia Salary Paycheck Calculator.

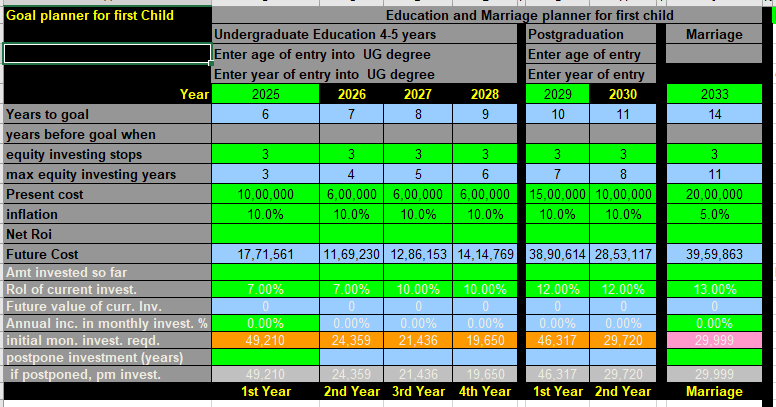

This calculator estimates Social Security benefits for single people who have never been married for married couples and for divorced individuals whose marriage lasted at least 10 years and who have not remarried. Others should use the calculator as if they were single. You get married then have children educate your children somewhere along the line you buy a home by taking a home loan.

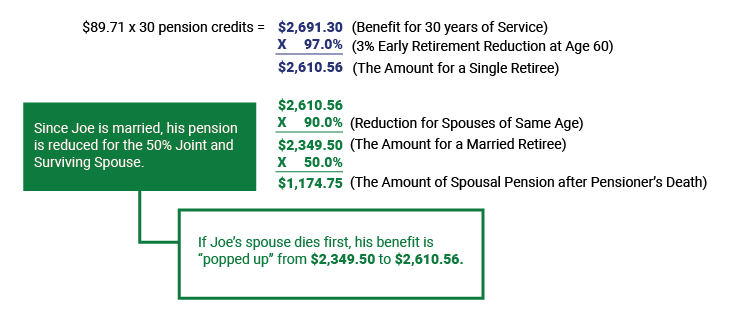

Youll need to input how much you extra you expect to get in the retirement income field. Changes in economic climate inflation achievable returns and in your personal situation will impact your plan. On average husbands are three years older than their wives in the US and spouses often coordinate their retirement decisions.

Office of the Chief Actuary. Further you can use this Retirement Calculator to find out the future value of your current expenses. Retirement planning is complicated.

Married filing jointly or qualified widower More than 208000. While your plan may not have a deferral percentage limit this calculator limits deferrals to 80 to account for FICA Social Security and Medicare taxes. Aansh Malhotra would need at retirement.

The MSN retirement calculator in 2011 has as the defaults a realistic 3 per annum. The calculations are based on information you entered and do not reflect the full complexity of federal income tax law. When you are part of a couple there are double the financial considerations.

The impact on your paycheck might be less than you think. If married you also obviously want separate controls for your spouse. Forecasts Social Security health care.

See more about special considerations regarding retirement calculator for couples Expenses. While increasing your retirement account savings does lower your take home pay it also lowers your Federal income tax withholding. Lets see how much Mr.

For example if you retire at age 65 your last contribution occurs when you are actually age 64. States are slowing beginning to provide state-run auto-IRA programs to bridge the gap for. Most people are married when they reach retirement age.

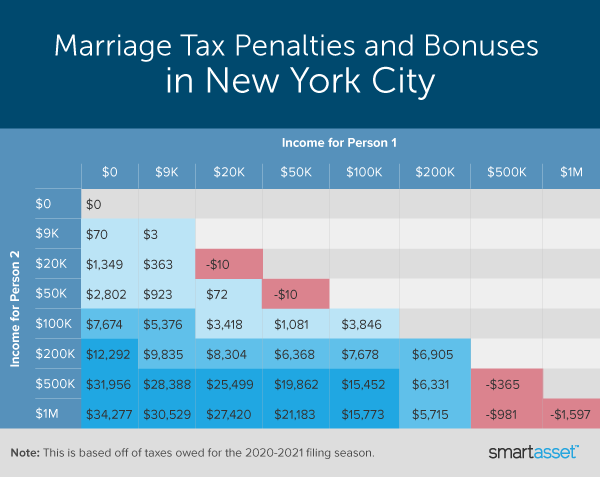

One of the most realistic retirement calculators. This calculator also assumes that you make your entire contribution at the end of. Marriage has significant financial implications for the individuals involved including its impact on taxation.

But suppose your retirement benefit is only 900 a month. Your spousal benefit would be 1000 half of your spouses benefit so Social Security will in effect ignore it and pay your higher retirement benefit of 1200. Apply for Benefits Online.

Calculate your California net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free California paycheck calculator. Once you start the calculator youll be able to post your own questions too. Covers couples inflation pensions mortgages taxes events.

Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Georgia paycheck calculator. A Retirement calculator is an online tool that helps in determining the retirement corpus. After retirement your spending is likely to evolve.

Because living expenses are usually lower in retirement 60-80 of your pre-retirement income may be enough to live on depending on your desired lifestyle in retirement. This data breaks down individual balances by age group but for married couples targets will differ depending on the couples age household income and whether there is a sole earner or dual income. Are other forms of retirement income taxable in Montana.

An individual retirement account is one of the most popular ways to save for retirement given its large tax advantages. If youre widowed you may be entitled to survivors benefits. This pre-retirement calculator was developed to help you determine how well you have prepared and what you can do to improve your retirement outlook.

Based on your respective earnings records your retirement benefit is 1200 a month and your spouses is 2000. Age at retirement Age at which you plan to retire. On average someone under age 25 is saving less than 7000 while someone between ages 55 and 64 averages just over 232000.

Retirement Survivors Benefits. It is important that you re-evaluate your preparedness on an ongoing basis. Married filing jointly or qualifying widower More than 125000.

Retirement expense calculator Close. Other Things to Consider.

Marriage Penalty Vs Marriage Bonus How Taxes Work

Retirement Planning For Couples

The 10 Best Retirement Calculators Newretirement

Ultimate Retirement Calculator Our Debt Free Lives Retirement Calculator Retirement Planner Early Retirement

Early Retirement Calculator Spreadsheets Budgets Are Sexy

Retirement Calculator For Couples Married Or Not

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

The 10 Best Retirement Calculators Newretirement

Retirement Savings Calculator Crown Org

Early Retirement Calculator Spreadsheets Budgets Are Sexy

The Average Net Worth For The Above Average Married Couple

Fire Up Comprehensive Calculator For Financial Freedom

The 10 Best Retirement Calculators Newretirement

United Association National Pension Fund Benefit Calculations

Fire Calculator When Can I Retire Early Engaging Data

The 10 Best Retirement Calculators Newretirement

The 10 Best Retirement Calculators Newretirement