Social security taken out of paycheck

If you receive Social Security benefits your monthly premium will be deducted automatically from that. Web Reserve and National Guard members have a new way to pay off their remaining 2020 SOCIAL SECURITY TAX balance Per the Presidential memorandum.

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

Web All employers are required to withhold Social Security tax from employees paychecks unless an exemption applies.

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

. If you receive a paycheck stub each payday. Web In 2022 the Social Security tax limit is 147000 up from 142800 in. You may be paying.

There is no exemption for paying the Federal Insurance Contribution Act FICA payroll taxes that. Web The Social Security tax rate in the United States is currently 124. Your employer most likely takes federal income tax Social Security tax Medicare tax and state income tax out of your paychecks.

Social Security and Medicare Tax. Unlike ordinary federal income tax brackets which tax higher incomes at a. Web With an income of 409000 or more youll need to pay 57830.

The Social Security Administration will soon announce the Cost of Living Increase COLA for 2023 benefits. There is no exemption for paying the Federal Insurance Contribution Act FICA payroll taxes that. Unlike ordinary federal income tax brackets which tax higher.

Web IRS tells companies to not take out Social Security taxes from checks following presidential order. Web If youre younger than full retirement age during all of 2020 the Social Security Administration will deduct 1 from your Social Security paycheck for every 2 you earn. There is no exemption for paying the Federal Insurance Contribution Act FICA payroll taxes that.

Web As of 2021 your wages up to 142800 147000 for 2022 are taxed at 62 for Social Security and your wages with no limit are taxed at 145 for Medicare. Thats because the IRS imposes a 124 Social Security tax and a 29 Medicare tax on net. Web By William Erickson 15062022.

Web Do I have to have Social Security taken out of my paycheck. The deferment is not an actual tax cut and because the deferment was done via. 21 2022 718 am.

Web There are several reasons social security tax was not withheld from your paycheck. You are a degree-seeking student in good standing attending school at least. Web Updated October 08 2018.

The question of how. Web How Much Social Security Tax Gets Taken Out of My Paycheck. Web Most Americans know it simply as the Social Security and Medicare taxes which take thousands of dollars annually from their paychecks.

The Social Security tax rate in the United States is currently 124. However you only pay half of this amount or 62 out of your paycheck -- the other half is paid by. However you only pay half of this amount or 62 out of your.

Web Do you have to have Social Security taken out of your paycheck. Web Its the federal law that requires employers to pay and withhold certain taxes from the wages they pay employees. If youre an employee youre probably wondering how often is health insurance taken out of a paycheck.

Web Dan Avery. FICA includes both Social. FICA mandates that three separate taxes be.

Web If you work for an employer your paycheck will likely show an amount withheld for FICA the Federal Insurance Contributions Act. Web Should Social Security be taken out of my paycheck. Web Employees do not pay this tax or have it withheld from their pay.

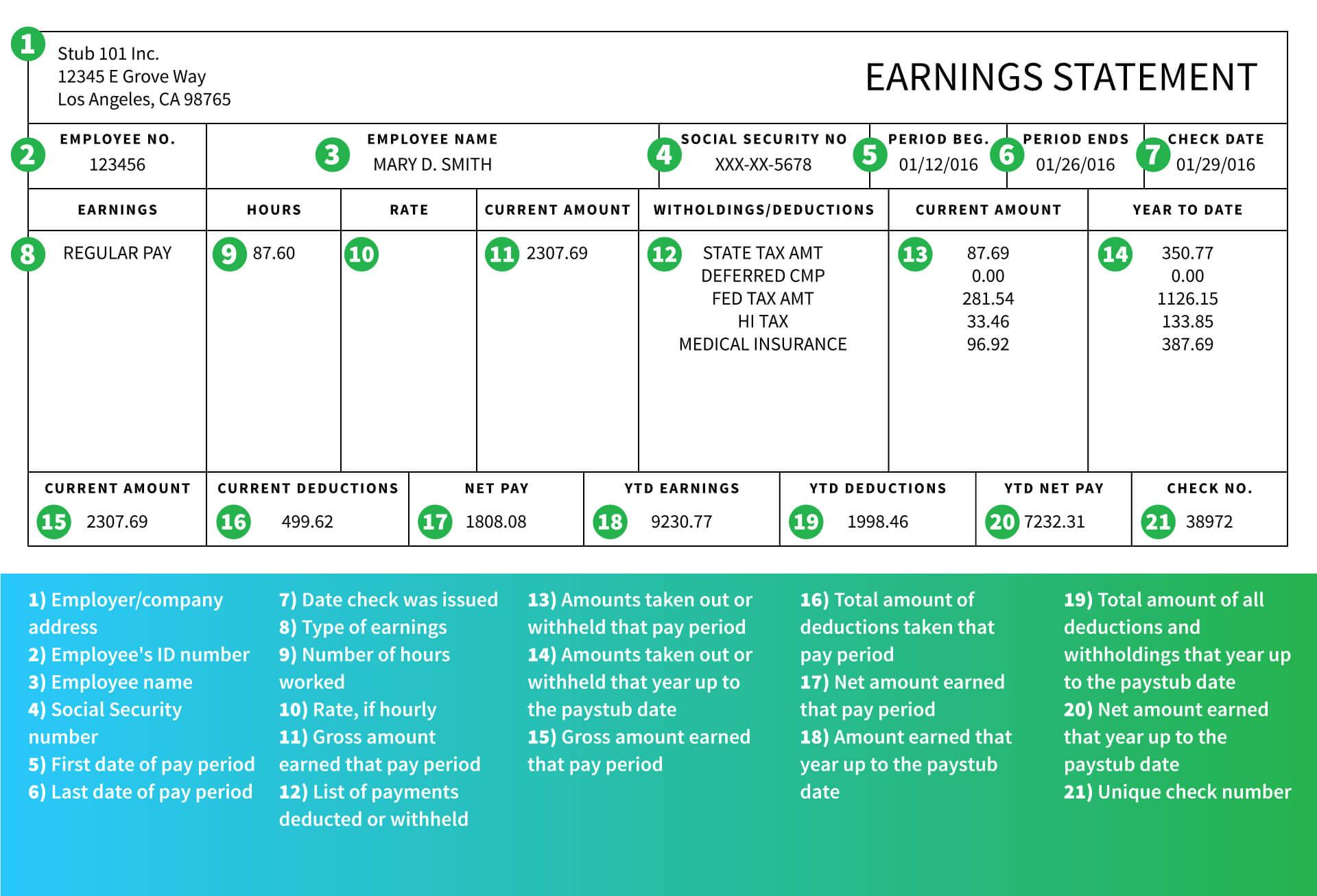

Pay Stub Meaning What To Include On An Employee Pay Stub

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Paycheck Taxes Federal State Local Withholding H R Block

Understanding Your Paycheck

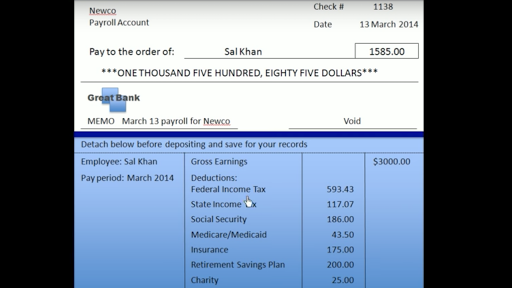

Anatomy Of A Paycheck Video Paycheck Khan Academy

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Understanding Your Paycheck Credit Com

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Common Pay Stub Errors California Employers Should Avoid

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

Is There A Way To Print A Social Security Number On The Pay Stub

How To Read A Pay Stub Gobankingrates

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Annual Compensation Vs Annual Salary

What Is A Pay Stub And What Does It Need To Include Hourly Inc

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Different Types Of Payroll Deductions Gusto

Is There A Way To Print An Employee Social Security Number On A Pay Stub In Qb Online